• The rand strengthened to levels not seen in years • Consumer confidence shot up to an all-time high in the first quarter of 2018 • Business confidence increased to 45 index points in the first quarter of 2018, from 34 index points in the quarter before. • The country avoided a downgrade by ratings agency, Moodys, who anticipated a “more transparent and predictable policy framework”

for the country as inflation stabilised and reached 3.8% year on year in March 2018, the lowest inflation rate since February 2011.

stronger rand and decision by Moodys to maintain South Africa’s credit rating were key factors in the South African Reserve Bank’s decision to cut the interest rate by 25 basis points in March this year. The current prime lending rate of 10% is the lowest in two years.

has also taken welcome steps to overhaul ailing state-owned enterprises and tackle corruption, which are major drains on the economy.

Economists are expecting an improvement in GDP growth over the next two years. After growing by 1.3% in 2017, National Treasury currently anticipates growth of 1.5% in 2018, rising to 2.1% in 2020.

The OECD has revised the expected GDP growth rate upward to 1.9% in 2018, and 2.1% in 2019 – higher than the growth rate currently targeted by National Treasury.

The rating agency Moodys also expects GDP growth to exceed governments forecasts. They also expect economic growth to accelerate by 2% in 2018 and 2.1% in 2019.

With so much good news around, the economy and by extension the property market, looked set for take-off, but the Land Expropriation Issue and the 2018 Budget took some of the gloss off the positive start.

Land expropriation has been the cause of much panic and uncertainty in the market after it was adopted as ANC policy at their December conference. Although President Ramaphosa has repeatedly asserted that land grabs will not be tolerated, that only agricultural land is under consideration, that any action taken will be within the confines of the law and that extensive investigations and discussion will take place before anything is finalised, the issue has still caused confusion and uncertainty in the market.

Greater clarity and certainty will go a long way towards alleviating the negative sentiment around the issue.

The country had some of the ‘Ramaphoria’ knocked out of it by the “tough but hopeful” 2018 Budget. The budget, which was focused on rebuilding, brought with it some unpleasant tax hikes for South Africans.

• VAT was increased for the first time in 25 years - from 14% to 15% • income tax bands were not adjusted • excise duty and sin taxes went up • The fuel levy increased by by 52 cents a litre • benefits for medical expenses were reduced.

The tight budget ultimately meant that most South Africans will have less money in their pockets for investments like property.

Market activity Respondents in the FNB Estate Agent Survey reported greater activity in the market in the first quarter of 2018, after a 3-quarter decline. Higher activity levels could signal both economic and housing market strengthening to come in the near term.

House price growth Private Property’s asking price data for March shows year on year growth of 4.4% nationally.

Year on year change in asking price per province: Western Cape: 11% KwaZulu Natal: 7% North West: 5% Free State: 5% Eastern Cape: 2% Gauteng: 0% Mpumalanga: -1% Limpopo: -2% Northern Cape: -7%

It is worth noting that high level provincial asking price data is not reflective of the entire market. Within each province there are in-demand suburbs and property types that have shown exceptional price growth this year.

According to Betterbond, banks are more willing to grant homes at the moment, making it easier for buyers to get onto the property ladder. Their latest statistics show that the average approved bond size in SA is currently 6,05% higher than it was 12 months ago,

According to the FNB Estate Agent Survey for the 1st quarter of 2018, 1st time buyers don’t yet appear to be sharing in the improved sentiment apparent in the country early in 2018. The estimated average 1st time home buyer level was 17.6% of total home buying nationally, which is lower than the 20.28% of the previous quarter, and well off the high of 28% reached in the 2nd quarter of 2014.

There was some good news for sellers according to FNB. Houses spent less time on the market in the 1st quarter of 2018, declining from the previous quarter’s 17 weeks and 2 days to 14 weeks and 1 day.

FNB property strategist John Loos believes that the level of house price inflation was likely to increase to about 5.9% in 2018 on the back of improved sentiment and confidence in the country, up from real property price declines in 2017 and 2016.

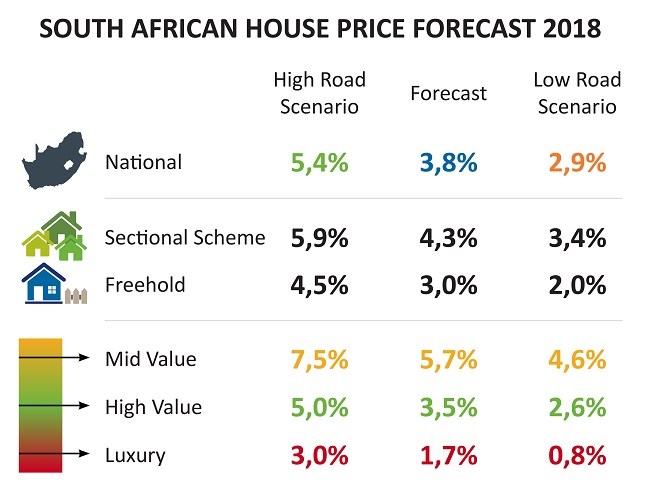

Property analytics company, Lightstone, forecasts house prices to remain stable, with growth nationally of around 4%, barring any major changes to the economy. Lightstone also forecast that the sectional title market will outperform the freehold market, and that lower-value properties will show better price growth than the higher end of the market.

altText Lightstone House Price Forecast 2018

The year started on a wave of optimism, with positive signs for the economy and the property market. While the mood is still positive, the reality is that any turnaround will not happen quickly.

The property market is showing signs of improvement in the wake of ‘Ramaphoria’, but, in order for the property market to really prosper, it will need greater political and economic stability. If the noise around land expropriation subsides, the political environment remains stable and the economy shows real growth, we can look forward to the property market taking great strides forward.

Courtesy of Private Property

Smallholdings for sale on Facebook - Stay in the loop

Smallholdings on FB - News and Updates from the horses mouth

Direct listings right here - buying or selling we can help YOU